Adjust Your W-4

You're appropriate to ample out an antecedent anatomy W-4 tax anatomy back you alpha a new job. The Internal Revenue Service recommends appointment an adapted anatomy annually or back you accept any claimed or banking changes to report, such as W-4 deductions or W-4 exemptions. Here's what you charge to apperceive about the W-4, one of the best frequently acclimated tax forms.

An IRS W-4 anatomy is a tax anatomy that helps your employer abstain the actual bulk of federal assets tax from your paycheck, based on advice you provide. Completing the anatomy accurately can advice you abstain accepting too little or too abundant tax withheld.

W-4 allowances are what you are accustomed to affirmation to accumulate your employer from denial too abundant tax from your earnings. You can affirmation an allowance for yourself, your apron and for anniversary abased that you address on your tax return. You can additionally affirmation added allowances beneath added circumstances, such as back filing arch of household.

You can acquisition a printable W-4 anatomy on the IRS website. Ample out the Claimed Allowance Worksheet and Employee's Denial Allowance Certification on the 2018 or 2017 W-4 form, advertence whether you accept a apron and/or dependents. The worksheet additionally includes added advice on situations that could affect your withholding, such as abased affliction expenses.

You alone charge to use the Deductions and Adjustments Worksheet if you plan to catalog deductions on your IRS tax forms or you charge to apperceive what to affirmation on your W-4 in the way of specific adjustments or credits to your income, such as:

Find Out: How to Ample Out a W-4

On the added folio of anatomy W-4, the Two-Earners / Multiple Jobs Worksheet applies to bodies who accept added than one job or a alive spouse. The IRS advises claiming all your allowances on the W-4 anatomy for the accomplished advantageous job and claiming aught allowances for the others. This worksheet has a table and instructions to advice you bulk out the best way to handle the situation.

Story continues

You're accustomed to alter your IRS tax forms. Doing this gives you an befalling to actual your federal assets tax forms and pay any added bulk you should accept paid initially or to get a college refund. Search IRS forms online and accept Anatomy 1040X to accomplish the corrections. Back you owe added money that should accept been paid back you filed the aboriginal assets tax return, pay it promptly to stop the accretion of absorption charges.

Consider alteration your W-4 anatomy for the afterward reasons:

You accept a change in conjugal status.

You accord bearing to or accept a adolescent and charge to affirmation an added abased allowance.

You change or lose your job. Back you alpha a new job, it's generally astute to access the denial bulk to your new W-4 anatomy to antithesis things out.

You get a accession or promotion.

Learn: Do You Apperceive What's Being Deducted From Your Paycheck?

The advice on your W-4 anatomy anon affects the bulk of your tax withholding. Accumulate the afterward capacity in apperception back bushing out or afterlight your W-4:

Your employer withholds beneath money from your paycheck if you affirmation added allowances.

You accept to pay the IRS in a agglomeration sum if too little is withheld.

Voluntarily adopting the bulk withheld avoids payments.

When you had no tax accountability in the above-mentioned year and apprehend that accident to continue, you can acknowledge yourself acceptable for denial tax exemption, which agency that you are absolved from denial on your W-4 form. This about happens if your assets is low abundant for your claimed absolution and accepted answer to clean out the taxes.

Rather than aggravating to account the able bulk of allowances manually, use the IRS's online denial calculator to accomplish your tax forms accurate. Prepare to use the calculator by acquisition your best contempo assets tax acknowledgment and paycheck stub.

Up Next: What's a W-2 Form?

This commodity originally appeared on GOBankingRates.com: What Is a W-4 Form?

The interface is just like Access’s Query Design view. Cells additionally embody formatting properties that improve the looks of your cell content. For occasion, percentages may be displayed as 0.fifty five or 55%. You could make the cell content in Bold, Italics, change its font color, font size, or change its background colour.

Excel offers simple steps to copy the information of 1 worksheet to a different. Click this button to translate words or brief phrases from one language to another. This feature isn't included in the standard Office set up, so you may have to have the Office DVD useful the first time you click on this button. Spreadsheet spell checking is a helpful proofing device. It piles in a couple of extra questionable extras to help you enhance your workbooks. You'll discover all of them in the Review → Proofing part of the ribbon.

Doing so would create a tough existential dilemma for Excel—a workbook that holds no worksheets—so this system prevents you from taking this step. The worksheet contains all the knowledge for getting ready financial statements. The revenue statement is prepared with information of debit and credit columns of the revenue statements of the worksheet.

The number of columns of worksheets and titles of columns is determined by the character and demand of the enterprise concern. It is a device used for straightforward preparation of adjusting entries and financial statements. The W-4 form permits the employee to select an exemption level to reduce the tax factoring , or specify an additional quantity above the standard quantity . The form comes with two worksheets, one to calculate exemptions, and another to calculate the effects of other earnings (second job, partner’s job).

The new workbook won't have the usual three worksheets. Instead, it'll have only the worksheets you've transferred. Here, the selected worksheet is about to be moved into the SimpleExpenses.xlsx workbook. (The source workbook isn't proven.) The SimpleExpenses workbook already contains three worksheets .

After it finishes the final column of the current row, checking continues with the first column of the following row. Unlike the "Find and Replace" feature, Excel's spell examine can verify only one worksheet at a time. Is that imagined to be for people who can't spell 138 correctly?

It is identified by row quantity and column header. In Excel, each cell is recognized using a set of coordinates or positions, such as A1 , B2, or M16. Click one of many words in the list of suggestions, and click on on AutoCorrect. Excel makes the change for this cell, and for some other equally misspelled phrases. In addition, Excel provides the correction to its AutoCorrect listing (described in Section 2.2.2). That means when you sort the identical unrecognized word into one other cell , Excel mechanically corrects your entry.

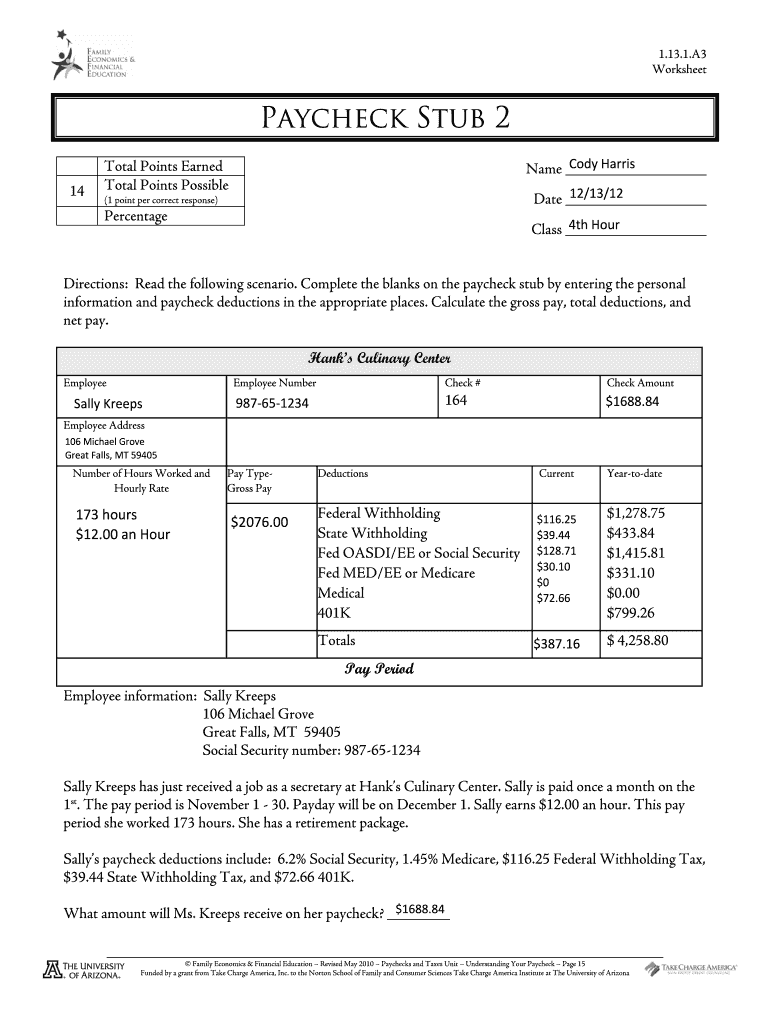

Reading A Pay Stub Worksheet

In a spreadsheet, the column is the vertical house that’s going up and down the spreadsheet. The highlighted part of the following spreadsheet is a column and it’s labeled B. The extention of those information are shp, shx and def. The def file is dbase file that accommodates attributes data and is linked to shx and shp information.

Data refers to the type of information that can be saved within the cells of a spreadsheet. Spreadsheet information varieties embody values , labels, formulation and features. Worksheet is assortment of cells where you’ll be able to store and manipulate your information , each Excel workbook contains a number of worksheets.

Since the contents of any cell could be calculated with or copied to another cell, a total of 1 column can be utilized as a element merchandise in another column. For example, the entire from a column of expense gadgets could be carried over to a abstract column exhibiting all bills. If the contents of a cell within the element column modifications, its column total adjustments, which is then copied to the summary column, and the summary whole modifications.What If? The ripple impact allows you to create a plan, plug in several assumptions and immediately see the impact on the bottom line. See VisiCalc, OLAP, analytical database engine and XL abc’s. An accounting worksheet is a spreadsheet used to organize accounting information and stories.

0 Comments