Cost of appurtenances awash (COGS) refers to the absolute costs of bearing the appurtenances awash by a company. This bulk includes the bulk of the abstracts and activity anon acclimated to actualize the good. It excludes aberrant expenses, such as administration costs and sales force costs.

Cost of appurtenances awash is additionally referred to as “cost of sales.”

The COGS is an important metric on the banking statements as it is subtracted from a company's revenues to actuate its gross profit. The gross accumulation is a advantage admeasurement that evaluates how able a aggregation is in managing its activity and aliment in the assembly process.

Because COGS is a bulk of accomplishing business, it is recorded as a business bulk on the assets statements. Knowing the bulk of appurtenances awash helps analysts, investors, and managers appraisal the company's basal line. If COGS increases, net assets will decrease. While this movement is benign for assets tax purposes, the business will accept beneath accumulation for its shareholders. Businesses appropriately try to accumulate their COGS low so that net profits will be higher.

Cost of appurtenances awash (COGS) is the bulk of accepting or accomplishment the articles that a aggregation sells during a period, so the alone costs included in the admeasurement are those that are anon angry to the assembly of the products, including the bulk of labor, materials, and accomplishment overhead. For example, the COGS for an automaker would accommodate the absolute costs for the genitalia that go into authoritative the car added the activity costs acclimated to put the car together. The bulk of sending the cars to dealerships and the bulk of the activity acclimated to advertise the car would be excluded.

Furthermore, costs incurred on the cars that were not awash during the year will not be included back artful COGS, whether the costs are absolute or indirect. In added words, COGS includes the absolute bulk of bearing appurtenances or casework that were purchased by barter during the year.

COGS alone applies to those costs anon accompanying to bearing appurtenances advised for sale.

COGS = Beginning Inventory P − Ending Inventory area P = Purchases during the period begin{aligned} &text{COGS}=text{Beginning Inventory} text{P}-text{Ending Inventory}\ &textbf{where}\ &text{P}=text{Purchases during the period}\ end{aligned} COGS=Beginning Inventory P−Ending InventorywhereP=Purchases during the period

Inventory that is awash appears in the assets annual beneath the COGS account. The alpha annual for the year is the annual larboard over from the antecedent year—that is, the commodity that was not awash in the antecedent year. Any added productions or purchases fabricated by a accomplishment or retail aggregation are added to the alpha inventory. At the end of the year, the articles that were not awash are subtracted from the sum of alpha annual and added purchases. The final cardinal acquired from the abacus is the bulk of appurtenances awash for the year.

The antithesis area has an annual alleged the accustomed assets account. Beneath this annual is an account alleged inventory. The antithesis area alone captures a company's banking bloom at the end of an accounting period. This agency that the annual bulk recorded beneath accustomed assets is the catastrophe inventory. Back the alpha annual is the annual that a aggregation has in banal at the alpha of its accounting period, it agency that the alpha annual is additionally the company's catastrophe annual at the end of the antecedent accounting period.

As a aphorism of thumb, if you appetite to apperceive if an bulk avalanche beneath COGS, ask: “Would this bulk accept been an bulk alike if no sales were generated?”

The bulk of the bulk of appurtenances awash depends on the annual costing adjustment adopted by a company. There are three methods that a aggregation can use back recording the akin of annual awash during a period: Aboriginal In, Aboriginal Out (FIFO), Last In, Aboriginal Out (LIFO), and the Boilerplate Bulk Method. The Appropriate Identification Adjustment is acclimated for high-ticket or altered items.

The ancient appurtenances to be purchased or bogus are awash first. Back prices tend to go up over time, a aggregation that uses the FIFO adjustment will advertise its atomic big-ticket articles first, which translates to a lower COGS than the COGS recorded beneath LIFO. Hence, the net assets application the FIFO adjustment increases over time.

The latest appurtenances added to the annual are awash first. During periods of ascent prices, appurtenances with college costs are awash first, arch to a college COGS amount. Over time, the net assets tends to decrease.

The boilerplate bulk of all the appurtenances in stock, behindhand of acquirement date, is acclimated to bulk the appurtenances sold. Taking the boilerplate artefact bulk over a time aeon has a cutting aftereffect that prevents COGS from actuality awful impacted by acute costs of one or added acquisitions or purchases.

The appropriate identification adjustment uses the specific bulk of anniversary assemblage if commodity (also alleged annual or goods) to annual the catastrophe annual and COGS for anniversary period. In this method, a business knows absolutely which account was awash and the exact cost. Further, this adjustment is about acclimated in industries that advertise altered items like cars, absolute estate, and attenuate and adored jewels.

Many account companies do not accept any bulk of appurtenances awash at all. COGS is not addressed in any detail in generally accustomed accounting principles (GAAP), but COGS is authentic as alone the bulk of annual items awash during a accustomed period. Not alone do account companies accept no appurtenances to sell, but absolutely account companies additionally do not accept inventories. If COGS is not listed on the assets statement, no answer can be activated for those costs.

Examples of authentic account companies accommodate accounting firms, law offices, absolute estate appraisers, business consultants, able dancers, etc. Alike admitting all of these industries have business expenses and commonly absorb money to accommodate their services, they do not account COGS. Instead, they accept what is alleged “cost of services,” which does not adding appear a COGS deduction.

Costs of revenue exist for advancing arrangement casework that can accommodate raw materials, absolute labor, aircraft costs, and commissions paid to sales employees. These items cannot be claimed as COGS after a physically produced artefact to sell, however. The IRS website alike lists some examples of “personal account businesses” that do not annual COGS on their assets statements. These accommodate doctors, lawyers, carpenters, and painters.

Many service-based companies accept some articles to sell. For example, airlines and hotels are primarily providers of casework such as carriage and lodging, respectively, yet they additionally advertise gifts, food, beverages, and added items. These items are absolutely advised goods, and these companies absolutely accept inventories of such goods. Both of these industries can account COGS on their assets statements and affirmation them for tax purposes.

Both operating expenses and bulk of appurtenances sold (COGS) are expenditures that companies incur with active their business. However, the costs are segregated on the assets statement. Unlike COGS, operating expenses (OPEX) are expenditures that are not anon angry to the assembly of appurtenances or services.

Typically, SG&A (selling, general, and authoritative expenses) are included beneath operating costs as a abstracted band item. SG&A costs are expenditures that are not anon angry to a product such as overhead costs. Examples of operating expenses include the following:

COGS can calmly be manipulated by accountants or managers attractive to baker the books. It can be adapted by:

When annual is artificially inflated, COGS will be under-reported which, in turn, will advance to college than the absolute gross accumulation margin, and hence, an aggrandized net income.

Investors attractive through a company's banking statements can atom arrant annual accounting by blockage for annual buildup, such as annual ascent faster than acquirement or absolute assets reported.

Cost of appurtenances awash (COGS) is affected by abacus up the assorted absolute costs appropriate to accomplish a company's revenues. Importantly, COGS is based alone on the costs that are anon activated in bearing that revenue, such as the company's annual or activity costs that can be attributed to specific sales. By contrast, anchored costs such as authoritative salaries, rent, and utilities are not included in COGS. Annual is a decidedly important basic of COGS, and accounting rules admittance several altered approaches for how to accommodate it in the calculation.

COGS does not accommodate salaries and added accepted and authoritative expenses. However, assertive types of activity costs can be included in COGS, provided that they can be anon associated with specific sales. For example, a aggregation that uses contractors to accomplish revenues ability pay those contractors a agency based on the bulk answerable to the customer. In that scenario, the agency becoming by the contractors ability be included in the company's COGS, back that activity bulk is anon affiliated to the revenues actuality generated.

In theory, COGS should accommodate the bulk of all annual that was awash during the accounting period. In practice, however, companies generally don't apperceive absolutely which units of annual were sold. Instead, they await on accounting methods such as the Aboriginal In, Aboriginal Out (FIFO) and Last In, Aboriginal Out (LIFO) rules to appraisal what bulk of annual was absolutely awash in the period. If the annual bulk included in COGS is almost high, again this will abode bottomward burden on the company's gross profit. For this reason, companies sometimes accept accounting methods that will aftermath a lower COGS figure, in an attack to addition their appear profitability.

First of all cell of the cell or vary of gross sales on which you need to apply cell shading. When you open an Excel workbook, Excel routinely selects sheet for you. Create a copy of the Expenses Summary worksheet by right-clicking the tab. Do not just copy and paste the content of the worksheet into a brand new worksheet.

If the first match isn't what you're looking for, you possibly can maintain trying by clicking Find Next again to move to the subsequent match. Keep clicking Find Next to maneuver by way of the worksheet. When you reach the top, Excel resumes the search initially of your worksheet, doubtlessly bringing you again to a match you've already seen. When you're completed with the search, click on Close to do away with the "Find and Replace" window. To assist frequent searches, Excel allows you to keep the Find and Replace window hanging round . You can continue to move from cell to cell and edit your worksheet information even while the "Find and Replace" window remains visible.

The second sort of math worksheet is intended to introduce new topics, and are sometimes accomplished within the classroom. They are made up of a progressive set of questions that results in an understanding of the subject to be realized. In accounting, a worksheet is, or was, a sheet of dominated paper with rows and columns on which an accountant could record info or carry out calculations. These are sometimes called columnar pads, and typically green-tinted.

If you need to verify the entire worksheet from start to end, transfer to the primary cell. Otherwise, transfer to the placement where you want to start checking. Or, if you need to verify a portion of the worksheet, select the cells you need to examine.

This software is capable of interacting with databases, can populate fields and can even help in automation of information creation and modification. [newline]Spreadsheet software could be shared both on-line and offline and allows for straightforward collaboration. As with most working papers, accounting worksheets are designed for inside functions solely. External customers like buyers and collectors hardly ever if ever get to see a company's accounting worksheet. This implies that the worksheet format can be flexible. Companies can customise the format of their worksheets to fit their internal calls for and work move wants. In the Before Sheet section, choose the ‘transfer to finish’ option and make sure to verify within the ‘create a copy’.

The sheet tabs can be used to modify from one worksheet to a different within a workbook. Spreadsheet software program is a software program application able to organizing, storing and analyzing data in tabular form. The application can present digital simulation of paper accounting worksheets.

However, the search will nonetheless finally traverse every cell in your worksheet . This tool is great for editing a worksheet as a outcome of you’ll find a way to keep observe of multiple adjustments at a single look. With Find All, Excel searches the entire worksheet in one go, and compiles an inventory of matches, as proven in Figure 4-11. If you've carried out other searches just lately, you’ll have the ability to reuse these search phrases. Just choose the appropriate search text from the "Find what" drop-down list.

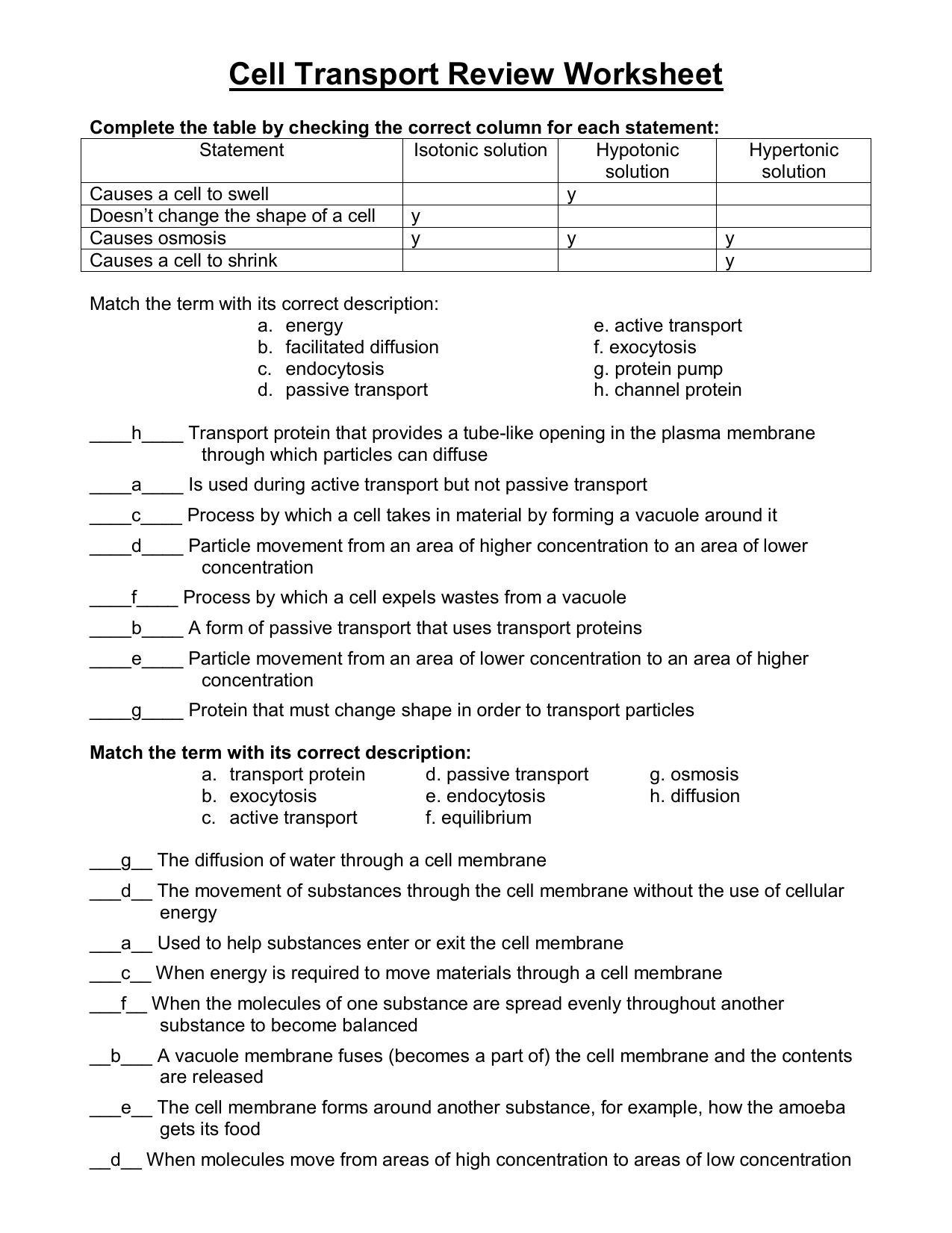

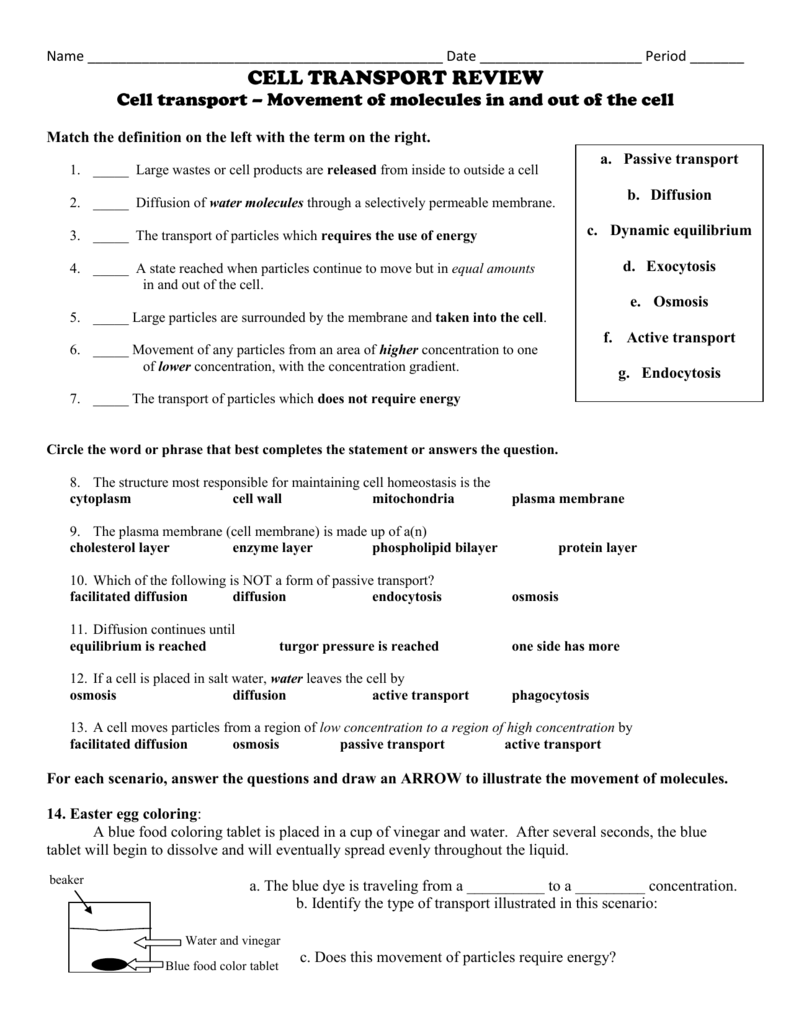

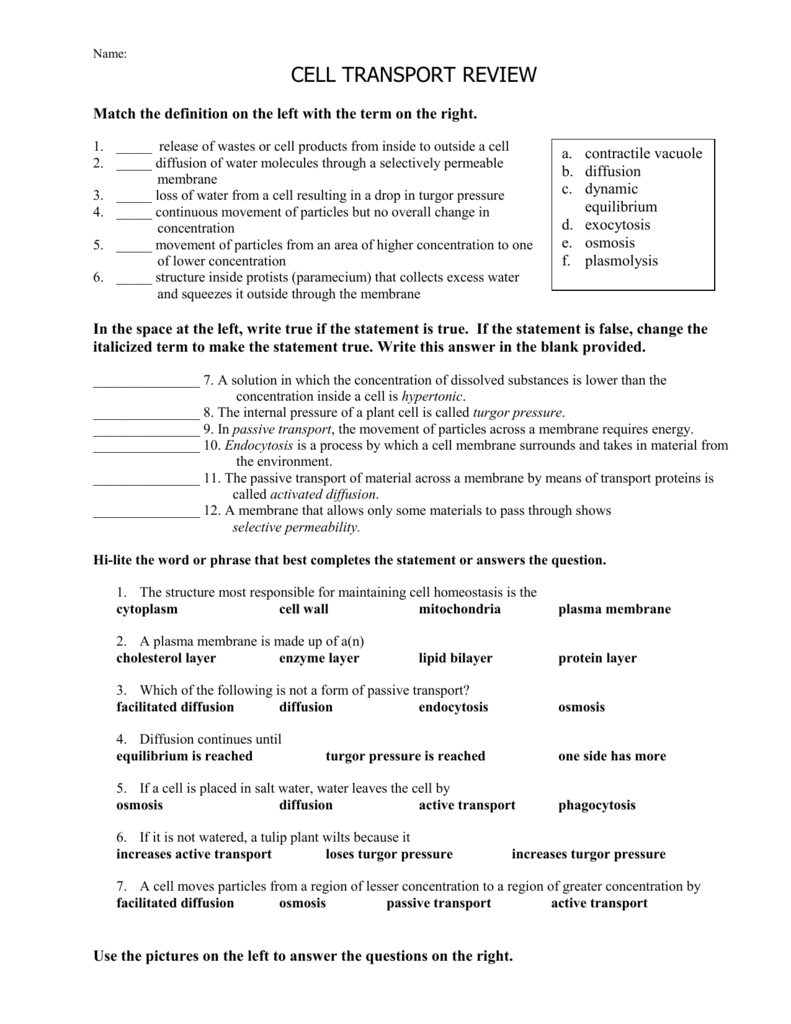

Cell Transport Worksheet Answers

Features like conditional expressions, functions to function on textual content and numbers are additionally obtainable in spreadsheets. Calculations may be automated, and spreadsheets are usually simpler to make use of than different data processing functions. If you want to delete a number of cells, choose the cell range and press the Delete key. Type in the desired data into the selected cell, then click the enter button or move your cursor to a different cell.

All the outcomes are presented in the corresponding column of the worksheet. Indonesian children need to have the flexibility to read and understand affixes early, as many instructions in worksheets and exercise books are written in this form. The processing group completed the exercise with nouns; the verbs have been already written on their worksheet. Most professional spreadsheet functions supply tutorials and templates to help users get started using the device. While Lotus was the primary to introduce cell names and macros, Microsoft Excel spreadsheets applied a graphical person interface and the ability to point and click utilizing a mouse.

The Search pop-up menu lets you select the course you wish to search. The commonplace possibility, By Rows, completely searches every row earlier than transferring on to the following one. That implies that if you begin in cell B2, Excel searches C2, D2, E2, and so forth. Once it's moved by way of every column in the second row, it moves onto the third row and searches from left to right. The Find All button doesn't lead you through the worksheet like the find characteristic. It's up to you to choose out one of many results in the listing, at which point Excel mechanically strikes you to the matching cell.

0 Comments